Tokenomics - ICO

PRDAO will mint a token called HIVE on 6/10 with the total supply of 100,000,000 tokens.

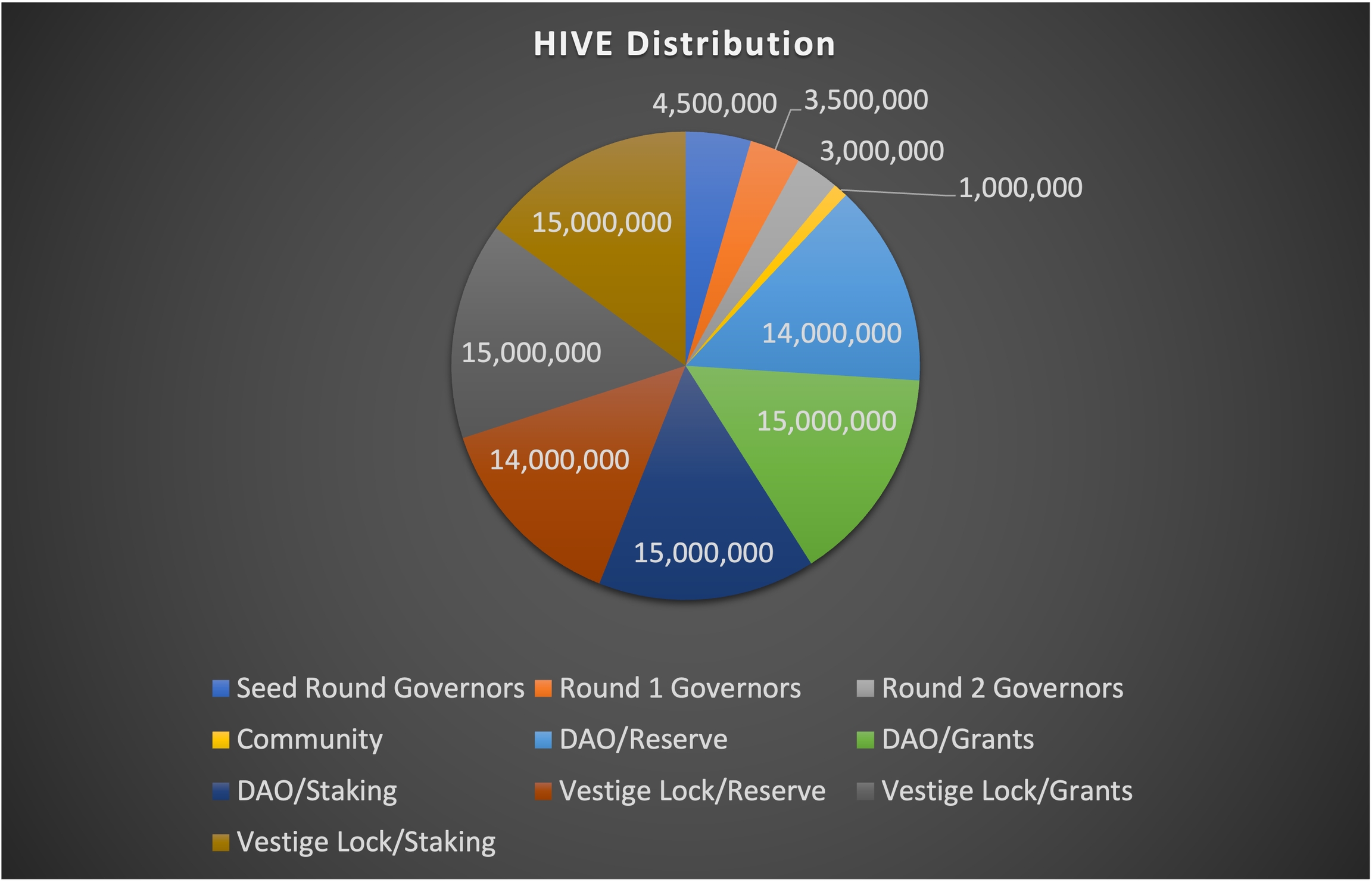

HIVE will be the primary token for the PRDAO platform and any platform revenue distribution will be airdropped in ALGO based on wallet weight of the HIVE tokens minus any tokens locked in vaults, the DAO Treasury management tool, or saved for unsold Governance NFTs. Out of the TTS, 11% or 11,000,000 tokens will be allocated to 225 Governance NFT holders in the following amounts:

Seed Round Governors: Comprising 45 Governance NFTs, will receive 100,000 HIVE tokens each.

Round 1 Governors: The 60 Governance NFT’s will receive 58,333.33 HIVE tokens per NFT they hold. Round 2 Governors: The remaining 120 Governance NFTs on the market, will receive 25,000 HIVE tokens per NFT when they are purchased.

1,000,000 additional HIVE tokens will be distributed to active community members through giveaways, contests, and platform testing at the teams discretion, by trading 1 POLYN token for 1 Hive Token to assist with decentralization.

The remaining 88,000,000 HIVE tokens will be split between the DAO Treasury Management Tool and Vestige Vaults. 3 allocations for Grants, Staking, and Reserve on the PRDAO platform and 3 for Grants, Staking and Reserve locked in a Vestige Vaults for 2 years.

The team will not receive a token allocation, but they have the option to purchase and own the Governance NFTs if they choose to do so. Alternatively, they can also acquire the HIVE tokens through the free market by buying them from DEXs.

Liquidity pools will be started by the team by using no more than 5,000 HIVE tokens from the Community allocation. And will remain until the liquidity added by others is at a more than 1/50 ratio to reduce impact. Liquidity will be started off on 6/15/23: ALGO/HIVE = .05 ALGO per HIVE Although the HIVE token is officially affiliated with PRDAO, the PRDAO team has no control over the token or its value after the initial liquidity is added. The purpose of the token is to put the control in the hands of the community and the team has made every effort to do this. Partnerships, or lack thereof, are completely in the hands of the Governors. If you wish to partner with the HIVE token, you can petition a Governor or become a Governor to create a Proposition. It will require a majority vote of Governors to release HIVE tokens from the DAO Treasury Management Vaults.

Last updated